Top Data Reconciliation Techniques Every Analyst Must Know

Share

In any data-driven role, from finance to marketing analytics, discrepancies between datasets are not just minor annoyances; they are critical failures that can lead to flawed insights, incorrect financial reporting, and poor strategic decisions. When your sales CRM and accounting software tell two different stories about last quarter's revenue, which one do you trust? This is where mastering data reconciliation techniques becomes less of a technical skill and more of an analytical superpower. Effective reconciliation ensures that your data sources are consistent, accurate, and reliable, forming the bedrock of trustworthy analysis.

This guide moves beyond theory to provide a practical roundup of essential data reconciliation techniques that every analyst should know. We will dissect seven distinct methods, giving you a clear roadmap for implementation. You will learn not just what each technique is, but how to apply it, its specific advantages and disadvantages, and where it shines in real-world scenarios.

From the foundational principles of Balance Reconciliation to the sophisticated automation of modern tools, this article will equip you with a versatile toolkit to tackle any data discrepancy. Consider this your definitive playbook for achieving data integrity, ensuring your reports are accurate, and your conclusions are sound. Let's dive into the methods that transform data chaos into cohesive, actionable intelligence.

1. Balance Reconciliation

Balance reconciliation is a foundational data reconciliation technique focused on comparing high-level, aggregate figures between two or more systems. Instead of matching individual transactions line-by-line, this method verifies that the total sum, count, or balance in one system matches the corresponding total in another. It serves as a crucial first-pass check to quickly identify if a discrepancy exists at a macro level.

This approach is highly efficient for getting a rapid health check of your data. If the balances match, you gain confidence in the data's integrity without a deep-dive investigation. If they don't, you know precisely where to focus your more detailed reconciliation efforts, saving significant time and resources.

When to Use Balance Reconciliation

This technique is most effective in scenarios where verifying the overall accuracy is the primary goal. It's an indispensable daily, weekly, or monthly control in financial and operational contexts.

- Financial Closing: Accountants use it to reconcile subsidiary ledger balances (like accounts receivable) with the main general ledger control account.

- Inventory Management: A retailer matches the total unit count for a product in their warehouse management system (WMS) against the count in their enterprise resource planning (ERP) system.

- Sales Reporting: A company compares the total sales revenue reported by its CRM with the total revenue recorded in its accounting software for a specific period.

Tips for Effective Implementation

To get the most out of balance reconciliation, consider these actionable tips:

- Set Tolerance Levels: Not all discrepancies are critical. Establish acceptable variance thresholds based on business impact. A $5 difference might be immaterial, but a $5,000 one requires immediate investigation.

- Automate Alerts: Configure your systems to automatically flag any reconciliation that breaches the predefined tolerance levels. This ensures timely intervention.

- Document Everything: Create clear procedures for investigating and resolving variances. This documentation is vital for consistency, training, and audit purposes. For a deeper understanding of identifying the root causes of these differences, check out this comprehensive guide to variance analysis in Excel on sumproductaddict.com.

2. Record-Level Matching

Record-level matching is a detailed data reconciliation technique that compares individual records or transactions between two or more systems. By using unique identifiers or a combination of key fields, this granular method enables the precise identification of missing, duplicate, or mismatched records, moving beyond high-level summaries to verify data integrity line by line.

This approach provides deep visibility into the root causes of discrepancies discovered during a balance reconciliation. While more resource-intensive, its precision is essential for operational accuracy, regulatory compliance, and building trust in your data sources. It confirms that not only do the totals match, but every single transaction contributing to that total is consistent across platforms.

When to Use Record-Level Matching

This technique is crucial in scenarios where the accuracy of individual transactions is non-negotiable and has a direct impact on operations, finance, or customer satisfaction.

- Financial Services: Credit card companies use it to match every single transaction between their authorization systems and the final settlement systems to prevent revenue loss or overcharging.

- Telecommunications: Providers reconcile individual call detail records (CDRs) across network switches and billing platforms to ensure accurate customer invoicing.

- Healthcare: Patient records are matched between clinical EMR systems and administrative billing systems to ensure services rendered are billed correctly, preventing compliance issues.

Tips for Effective Implementation

To implement record-level matching successfully, focus on creating a robust and efficient process:

- Establish Key Field Standards: Define and enforce consistent unique identifiers (like a transaction ID or customer number) across all integrated systems. This is the cornerstone of effective matching.

- Use Efficient Indexing: Implement indexing on the key matching fields in your databases. This dramatically speeds up query performance, especially when dealing with millions of records.

- Create Exception Workflows: Design a clear, automated process for handling exceptions. Unmatched records should be routed to a specific team or workflow for investigation and resolution, not left in a data limbo.

- Cleanse Data First: The quality of your matching depends heavily on the quality of your data. Before reconciling, it is vital to apply robust data cleaning processes. For a deeper dive, explore these essential data scrubbing techniques to master pristine data on sumproductaddict.com.

3. Statistical Reconciliation

Statistical reconciliation is an advanced data reconciliation technique that moves beyond direct comparisons. It uses statistical methods and mathematical models to identify discrepancies by analyzing variances, detecting trends, and isolating outliers. This powerful approach leverages statistical principles to uncover anomalies that might not be apparent through simple balance or transactional checks, making it ideal for large and complex datasets.

This method excels at finding the "unknown unknowns" in your data. Instead of looking for specific, expected mismatches, it identifies patterns and deviations from the norm that signal potential data quality issues. Tools like R, Python with pandas, and SAS are often used to build and execute these sophisticated models, providing a deeper layer of data integrity assurance.

When to Use Statistical Reconciliation

This technique is best suited for scenarios where data volumes are massive, and subtle, systemic errors are a concern. It is a proactive method for maintaining data quality and detecting fraud.

- Financial Trading: Investment banks employ statistical models to analyze millions of trades, detecting anomalies that could indicate errors, fraud, or market manipulation.

- Manufacturing Quality Control: A production facility can analyze sensor data from its assembly line to identify slight deviations in measurements that predict a future equipment failure or a dip in product quality.

- Insurance Fraud Detection: Insurers use statistical analysis to compare new claims against historical patterns, flagging claims that deviate significantly from the norm for further investigation.

Tips for Effective Implementation

To successfully implement statistical reconciliation, a more analytical approach is required:

- Establish Baselines: Use clean, historical data to build a baseline statistical model of what "normal" looks like. This model becomes the benchmark against which new data is compared.

- Calibrate Models Regularly: Business operations change, so your models must too. Regularly update and retrain your statistical models with recent data to ensure they remain accurate and relevant.

- Combine with Other Methods: Use statistical reconciliation as a complement to, not a replacement for, traditional methods. Use it to flag areas of concern that can then be investigated with transactional reconciliation.

- Invest in Training: Your team needs a solid understanding of statistical concepts to build, interpret, and maintain these models. To begin mastering the data transformation skills necessary for this type of analysis, explore this Excel Power Query tutorial on sumproductaddict.com.

4. Tolerance-Based Reconciliation

Tolerance-based reconciliation is a pragmatic data reconciliation technique that acknowledges and accepts minor, predefined discrepancies between datasets. Rather than demanding an exact match for every record, this method automatically approves variances that fall within an acceptable range, or "tolerance level." This focuses investigative efforts exclusively on material differences that truly impact business operations.

This approach prevents teams from wasting valuable time on insignificant variances caused by factors like rounding, foreign exchange rate fluctuations, or minor timing differences. By systematically ignoring the noise, analysts can concentrate on resolving discrepancies that pose a genuine risk to financial reporting or operational efficiency.

When to Use Tolerance-Based Reconciliation

This technique is ideal for high-volume environments where small, expected variances are common and investigating every single one is impractical. It brings efficiency to processes where perfect precision is less important than material accuracy.

- Foreign Exchange Transactions: A global e-commerce platform reconciles payments in different currencies. It can set a tolerance to account for minor fluctuations in exchange rates between the time of sale and settlement.

- Payroll Processing: When calculating payroll deductions and taxes across thousands of employees, minor rounding differences between the payroll system and the HR system are common. A tolerance of a few cents per employee can be set to avoid unnecessary exceptions.

- Supply Chain Logistics: A distributor might tolerate a small variance (e.g., +/- 1%) between the quantity of goods ordered and the quantity received, accounting for potential minor shipping errors or damages that are not worth pursuing.

Tips for Effective Implementation

To implement tolerance-based reconciliation successfully, you need clear rules and oversight to ensure it doesn't mask growing problems.

- Document Justification: For every tolerance level you set, clearly document the business reason behind it. This is crucial for internal controls, audits, and training new team members.

- Monitor Cumulative Impact: Small, tolerated differences can add up over time. Regularly analyze the cumulative total of all tolerated variances to ensure they don’t become a material amount. If they do, your tolerance levels may need adjustment.

- Implement Approval Workflows: Any changes to tolerance thresholds should go through a formal approval process. This prevents unauthorized adjustments that could hide significant errors or fraudulent activity.

- Alert on Near-Breaches: Set up alerts not just for breaches but also for transactions that are consistently close to the tolerance limit. This pattern could indicate a systemic issue that needs to be addressed before it becomes a larger problem.

5. Time-Based Reconciliation

Time-based reconciliation is a sophisticated data reconciliation technique designed to manage discrepancies that arise purely due to timing differences in data processing between systems. Instead of treating a mismatched transaction as an immediate error, this method applies time-shift logic or compares data across specific time windows to account for natural delays, such as processing lags or time zone differences. It is crucial for maintaining accuracy in environments where data is constantly in motion.

This approach prevents the false flagging of valid transactions that simply haven't been recorded in a destination system yet. By understanding and accommodating these inherent delays, businesses can avoid unnecessary investigations and focus only on true exceptions, making their reconciliation process far more efficient and intelligent.

When to Use Time-Based Reconciliation

This technique is essential for any operation where data flows between systems that do not update in perfect, real-time synchronization. It is particularly valuable in global and high-volume transaction environments.

- Global Banking: A bank reconciles transactions made in a London branch (GMT) at the end of its business day against its New York data center (EST), which is five hours behind. The reconciliation must account for this time zone gap.

- E-commerce Operations: An online store matches orders placed in its system with payment confirmations from a third-party processor. A payment confirmed a few minutes after the order was placed might fall into a different reporting period if a strict timestamp match is used.

- Stock Trading: Exchanges use time-based reconciliation to match trades executed on the floor with records in settlement systems, which often process transactions in batches at a later time.

Tips for Effective Implementation

To successfully implement time-based reconciliation, you need to define and manage your time parameters carefully.

- Establish Clear Cut-Off Times: Define and communicate strict cut-off times for daily or periodic processing. All transactions before this time belong to one period, and all after belong to the next, creating a clear line for comparison.

- Standardize Time Zones: Whenever possible, convert all transaction timestamps to a single, standardized time zone like Coordinated Universal Time (UTC) before comparison. This eliminates confusion and simplifies matching logic.

- Create Time Buckets: Instead of matching exact timestamps, group transactions into "time buckets" (e.g., 5-minute or 1-hour intervals). This allows for minor delays without causing a reconciliation failure.

- Document Business Rules: Comprehensively document all rules related to timing. For example, specify the acceptable lag time between an order and its shipment, as this logic is central to accurate time-based reconciliation. For more on creating effective business rules, see this guide from Harvard Business Review.

6. Exception-Based Reconciliation

Exception-based reconciliation is a highly focused data reconciliation technique that shifts the priority from confirming every matching record to efficiently managing the non-matching ones. Instead of processing entire datasets to find matches, this method is designed to isolate, categorize, and resolve only the discrepancies, or exceptions. It's a pragmatic approach that assumes most data is correct and directs resources toward fixing what is broken.

This technique is built around creating efficient workflows for exception handling. Once a discrepancy is identified, it is categorized and routed to the appropriate team or individual for investigation and resolution. This targeted strategy makes the reconciliation process faster and more scalable, especially for high-volume transaction environments where manually checking every record is impractical.

When to Use Exception-Based Reconciliation

This method is ideal for processes where discrepancies are inevitable but represent a small fraction of the total data volume. It excels in environments where speed and operational efficiency are critical.

- Payment Processing: A fintech company automatically reconciles millions of daily transactions between its platform and a bank's settlement file, focusing only on investigating the small percentage of failed, reversed, or disputed payments.

- Inventory Management: A large retailer’s system flags discrepancies between physical stock counts and system records, creating exception reports for store managers to investigate only the specific items with variances.

- Accounts Receivable: A B2B company focuses its efforts on managing exceptions in customer payments, such as short-pays or unapplied cash, rather than re-verifying every single invoice that was paid correctly.

Tips for Effective Implementation

To implement this technique effectively, the focus must be on creating a robust system for handling the exceptions themselves.

- Develop Exception Categories: Create a comprehensive and clear categorization scheme for discrepancies (e.g., 'Timing Difference,' 'Incorrect Amount,' 'Missing Transaction'). This helps in routing and analysis.

- Automate Routing and Alerts: Implement rules-based workflows that automatically assign exceptions to the correct personnel based on their category and severity. Real-time alerts ensure prompt attention.

- Establish Escalation Paths: Define clear procedures and timelines for escalating unresolved exceptions. This prevents critical issues from being neglected and ensures accountability. For more hands-on methods of surfacing these issues, review these powerful techniques for finding errors in Excel on sumproductaddict.com.

7. Automated Reconciliation

Automated reconciliation leverages technology to perform data comparison, identify exceptions, and manage resolution workflows with minimal human intervention. This advanced data reconciliation technique uses sophisticated algorithms, rules-based engines, and even machine learning to handle high-volume, complex matching scenarios that would be impractical or impossible to manage manually. It represents the pinnacle of efficiency in data integrity operations.

The core benefit of automation is its ability to transform reconciliation from a periodic, labor-intensive task into a continuous, exception-driven process. Instead of manually sifting through thousands of records, teams can focus their expertise on investigating and resolving the complex discrepancies that the system flags, dramatically improving productivity and accuracy.

When to Use Automated Reconciliation

Automation is best suited for environments characterized by large data volumes, high transaction frequencies, and complex matching rules. It's the go-to solution for enterprises looking to scale their operations and reduce operational risk.

- Financial Services: JPMorgan Chase uses automated systems to reconcile millions of trades daily, ensuring compliance and financial accuracy in a high-stakes environment.

- E-commerce & Retail: Companies like Amazon deploy automated reconciliation to match inventory levels, sales data, and payment records across their vast global network of fulfillment centers and online marketplaces.

- Payment Processing: Visa and other payment networks rely on real-time automated platforms to reconcile billions of transactions between issuing banks, acquiring banks, and merchants, guaranteeing the integrity of the global payment ecosystem.

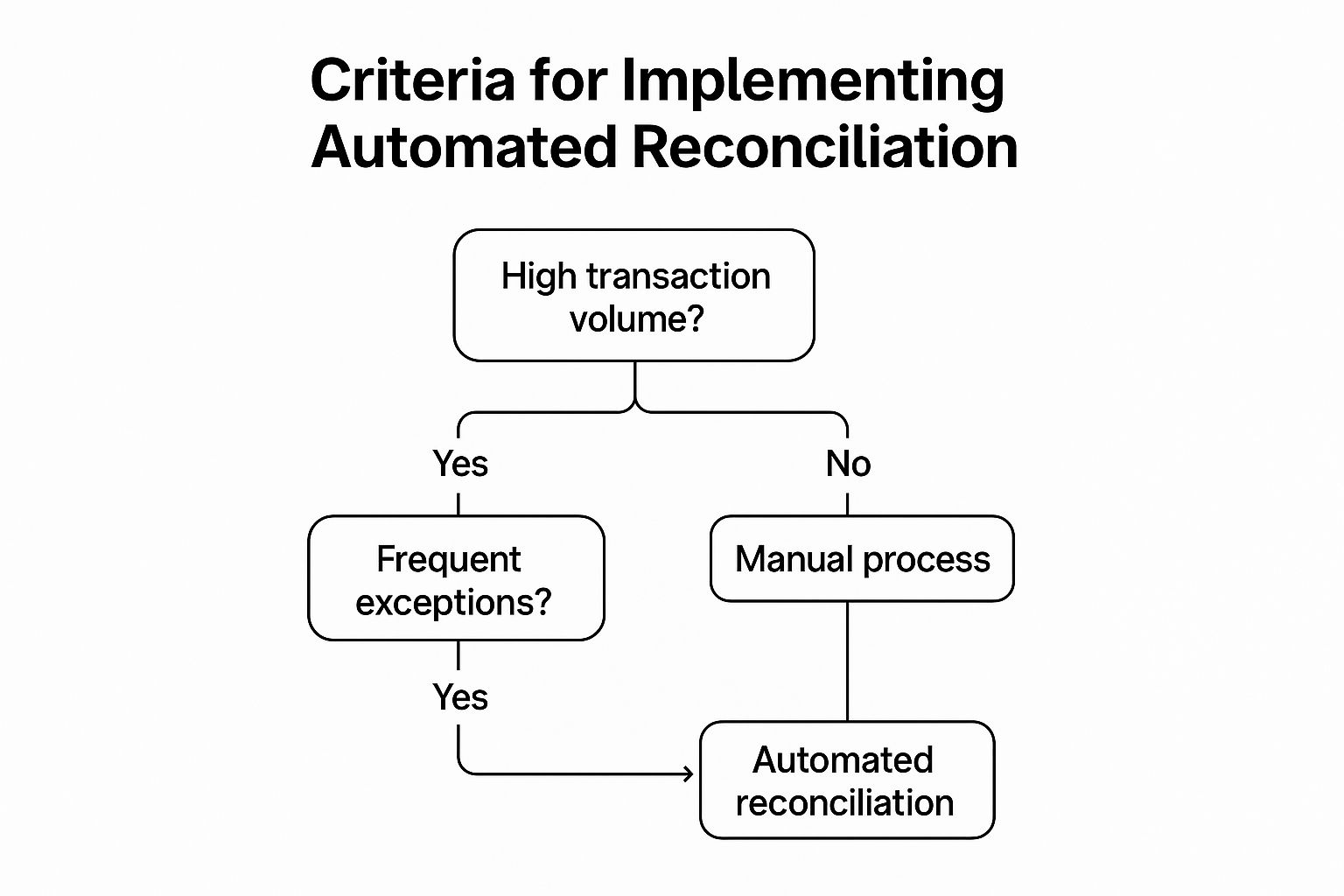

The following decision tree illustrates the key criteria for deciding whether to implement an automated reconciliation solution.

This visual guide highlights that a combination of high transaction volume and frequent exceptions makes a process a prime candidate for automation.

Tips for Effective Implementation

Transitioning to an automated system requires careful planning and execution. Platforms from providers like ReconArt, BlackLine, and Trintech offer robust solutions.

- Start with High-Volume Processes: Begin your automation journey with routine, high-volume reconciliations (e.g., bank or payment reconciliations) to achieve the quickest and most significant return on investment.

- Maintain Human Oversight: Automation handles the bulk of the work, but human expertise is irreplaceable for resolving complex, novel, or high-value exceptions. Design workflows that escalate these issues to the appropriate team members.

- Invest in Robust Monitoring: Implement comprehensive dashboards and alerting systems to monitor the health of the automation process itself. This ensures you can quickly detect and address any system-level issues or changes in data patterns. For more insights on leveraging technology, explore these strategies to automate data analysis for faster business insights on sumproductaddict.com.

Data Reconciliation Techniques Comparison

| Reconciliation Type | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Balance Reconciliation | Low - straightforward to implement | Low - minimal compute needed | Early detection of major discrepancies | Large datasets needing quick aggregate validation | Fast, easy to understand, automated with alerts |

| Record-Level Matching | High - complex logic and key matching | High - intensive compute & storage | Precise identification of detailed data issues | Transaction-level accuracy for financial, telecom, healthcare | Complete visibility, supports complex rules |

| Statistical Reconciliation | High - requires statistical expertise | Medium to high - CPU intensive | Detects subtle anomalies and patterns | Large, complex datasets needing anomaly detection | Probabilistic confidence, predictive capabilities |

| Tolerance-Based Reconciliation | Medium - setup of thresholds and rules | Medium - business rule dependent | Focused on material discrepancies | Environments with acceptable minor variations | Reduces noise, flexible, supports compliance |

| Time-Based Reconciliation | Medium to high - involves time logic | Medium - needs time handling | Accurate reconciliation despite timing differences | Cross-timezone/global operations, delayed processing data | Handles timing issues, reduces false positives |

| Exception-Based Reconciliation | Medium - requires workflows and categorization | Medium - exception tracking tools | Efficient resolution of identified problems | Processes focused on exception management | Maximizes efficiency, clear accountability |

| Automated Reconciliation | Very High - advanced technology required | High - advanced platforms & AI | Fast, accurate, real-time reconciliations | High-volume, frequent exceptions, real-time processing | Minimizes manual effort, scalable, consistent quality |

From Techniques to Trust: Building Your Reconciliation Strategy

Navigating the landscape of data reconciliation can feel like a complex puzzle, but as we've explored, you now possess a comprehensive toolkit to solve it. We've journeyed through seven distinct data reconciliation techniques, from the foundational certainty of Balance Reconciliation and the granular precision of Record-Level Matching to the pragmatic flexibility of Statistical and Tolerance-Based approaches. Each method offers a unique lens through which to view your datasets, ensuring you can tackle discrepancies with confidence and precision.

The key takeaway is that no single technique is a universal solution. The true power lies in understanding the context of your data and the specific business question you need to answer. A financial close demands the absolute accuracy of record-level matching, while analyzing large-scale marketing campaign data might benefit from the efficiency of statistical or tolerance-based methods to identify significant trends rather than minor variances. The goal is to move from a reactive, manual process to a proactive, strategic one.

Synthesizing Your Approach for Maximum Impact

Mastering these concepts is not just an academic exercise; it's a direct path to enhancing data integrity and, by extension, organizational trust. When stakeholders, from the C-suite to operational teams, can rely on the accuracy of your reports, decision-making becomes faster, more strategic, and ultimately more effective. The ability to choose the right reconciliation technique for the right scenario is a hallmark of a mature data practice.

Your next steps should focus on practical application and strategic implementation. Don't try to overhaul everything at once. Instead, identify a recurring, high-impact reconciliation challenge within your workflow and experiment with a new approach from this guide.

- Start Small: Pinpoint a specific process, like reconciling monthly sales figures between your CRM and accounting software.

- Select a Technique: Based on the data volume and required precision, choose the most appropriate method. Perhaps start with a simple balance check and then move to record-level matching for any identified discrepancies.

- Document Everything: Keep a log of your process, the tools you use (like SQL queries or Python scripts), and the outcomes. This creates a repeatable, auditable framework for future reconciliations.

- Embrace Automation: As you refine your manual processes, look for opportunities to automate. The Exception-Based and fully Automated Reconciliation techniques are your end goals for routine, high-volume tasks, freeing up your valuable analytical time for more strategic work.

By thoughtfully applying these data reconciliation techniques, you transform your role from a simple data checker to a guardian of data integrity. You build a foundation of trusted information that empowers your entire organization to operate with clarity and confidence, ensuring that every strategic move is based on a reality you have meticulously verified. This is the ultimate value of effective data reconciliation: it converts raw data into reliable intelligence.

Ready to take your data skills from the screen to your wardrobe? For those who live and breathe spreadsheets, SumproductAddict offers a unique line of apparel and gear designed for data professionals. Celebrate your passion for precision with clever, high-quality items that resonate with the analytical mindset. Check out the collection at SumproductAddict and wear your data-driven pride.